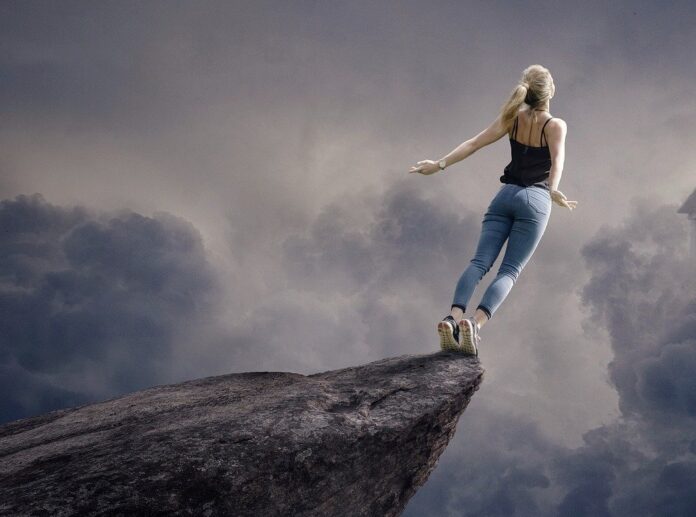

In these chaotic and uncertain times it’s acceptable, even expected, for a company to do some teetering – but virtually all experts agree that this should never take place on the brink.

“Teetering can be healthy for a business as long as it’s being done in the right location,” says Loretta Panzinger of Hallstrom/Davis consultants. “There are plenty of options, like on the precipice or on the edge of things like disaster or bankruptcy.”

But teetering on the brink, she says, invariably signals that a company is in trouble, scaring off potential employees and investors.

Sidney Ralston of the Coddington Institute agrees.

“I challenge you to show me a company these days that’s not teetering on something to at least some degree,” he says. If they’re doing it on the brink, however, he warns that they should be prepared to answer questions.

“They’ll ask things like why the teetering couldn’t have taken place earlier and somewhere else,” says Ralston. “And, ultimately, what was the reasoning behind taking the teetering all the way to the brink?”

Panzinger sites the example of two up and coming semi dot com companies that found themselves teetering for almost identical reasons: They were losing both market share and penetration parameters due to underestimating optic/variance equations.

“One company took the steps to ensure it was teetering on the margin and has since regained financial health,” she says. “The other didn’t make the appropriate plans and was on the brink within two months.”

That company, Panzinger says, was forced to lay off 90 percent of its employees and is now in the soap dispenser business.